Certified Private Equity Analyst

Investment managers and professionals working in the venture capital, investment as well as M&A sector that aim at gaining a certificate for their professional qualification.

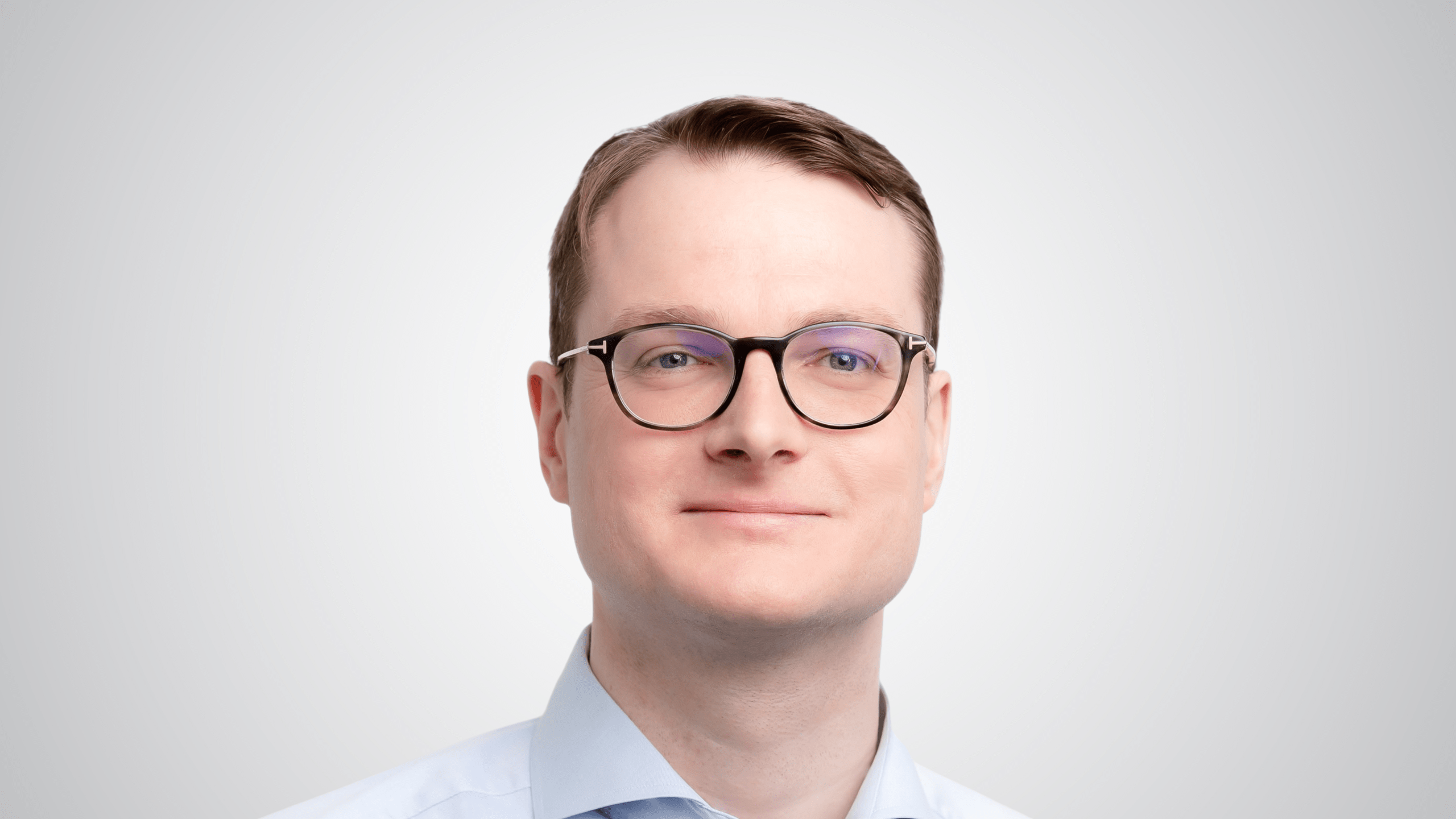

Prof. Dr. Christoph Kaserer

German (some material, e.g. case studies, might be in English)

15 presence days: 5 modules with 3 days each (Thursday – Saturday) over a period of 7 months starting in October:

Module 1: 16 – 18 October 2025

Module 2: 27 – 29 November 2025

Module 3: 05 – 07 February 2026

Module 4: 12 – 14 March 2026

Module 5: 23 – 25 April 2026

Prolonged until 7 August 2025

Certified Private Equity Analyst – Focus Private Equity / Venture Capital

10,750 EUR for members of BVK and our strategic cooperation partners (see below). 10% discount for TUM Alumni.

In the 2025/26 program year, we are awarding four partial fellowships worth 5,000 EUR each with our partners BVK and KfW Capital:

- One partial fellowship for all other equity and investment managers

- Two partial fellowships as part of the KfW Capital Fellowship Women in VC

- One partial fellowship for institutional investor

You can find more information and the application form for the partial fellowships here.

Application deadline: 31 May 2025

* Based on our experience, the German tax benefits help many of our participants to self-finance their education as these can be worth of up to 50% of tuition fees and program related travel costs. Please, consult your personal tax advisor for more details. For participants of our programs residing outside Germany this might be applicable, please check the situation with the local tax authorities in your country of residence.